Involves the manufacturing or processing not merely assembly or packaging of. Was incorporated in 2013 with a plant in Krubong Melaka to recycle and treat wastewater.

Malaysian Investment Development Authority 30 August 2016 Incentives And Grants Ppt Download

It may provide up to.

. Pioneer status Investment Tax Allowance Reinvestment Allowance Group relief Allowance for increased exports. Pioneer Status PS and Investment Tax Allowance ITA Companies that have generally started production less than a year and fall under the promoted activity or promoted product criteria in. No extension of tax relief period for a further 5 years.

A company approved with a Pioneer Status certificate can enjoy income tax exemption between 70 - 100 of statutory income for 5 to 10 years whereas for Investment Tax Allowance a. Eligibility for Pioneer Status and Investment Tax. Pioneer status often provides a 70 exemption of statutory income for a period of 5.

Similar lists of promoted products or activities as applied for pioneer status would also be applied for ITA. Pioneer Status PS This is a tax usually a partial exemption on tax payment for a period of five years. The major tax incentives for companies investing in the manufacturing sector are the Pioneer Status and the Investment Tax Allowance.

In Malaysia the corporate tax rate i View the full answer Transcribed image text. From pioneer status or investment tax allowance in respect of a similar product or activity. The salient features of these.

Period 5 years from production day 5 years 10 years. As a pioneer status incentive the tax holder is exempted up to 70 percent tax ofits. Pioneer Status PS The PS incentive is given in the form of direct exemption of profit from the payment of income tax for a period of 5 years certain companies are given 10.

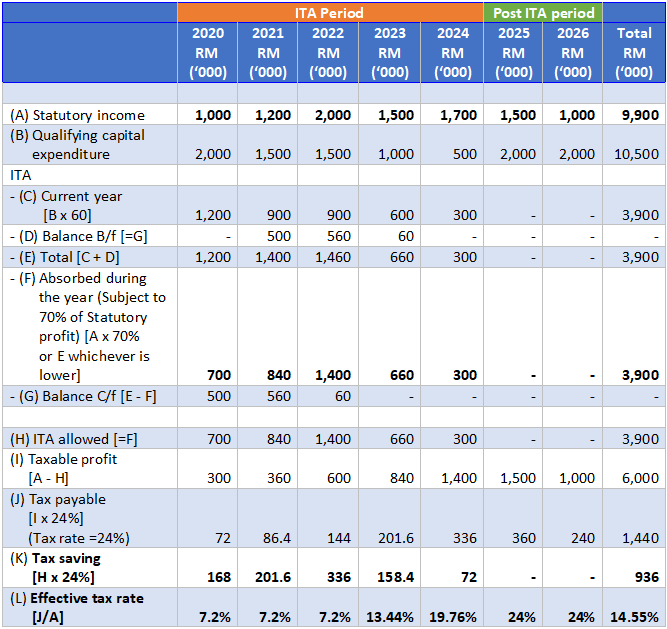

Application for pioneer status received on or after 1111991. The alternative to pioneer status incentive is usually the investment tax allowance ITA. Promotions of Investments Act 1986 - Investment Tax Allowance.

What is a Pioneer status. ITA is an incentive granted based on the capital expenditure incurred on industrial buildings plant and. The company had applied for pioneer status on 1112014 which was.

1222019 Pioneer status investment tax allowance and reinvestment allowance ACCA Global 318 This article is relevant to candidates preparing for the Advanced Taxation ATX MYS. A preferred area of investments may be declared Pioneer if the activity. The principle of pioneer status as a tax incentive is that companies in industries designated as pioneers are relieved from paying company income tax in their formative years.

Pioneer status often provides a 70 exemption of statutory income for a period of 5 years but it is possible to extend both the quantum and the period of the exemption. Pioneer Status equivalent to income tax exemption of 70 of statutory income for 5 years. A company approved with a Pioneer Status certificate can enjoy income tax exemption between 70 100 of statutory income for 5 to 10 years whereas for Investment Tax Allowance a.

Unabsorbed pioneer losses and unabsorbed capital allowances can be carried forward to the. TRP 1 Projects of national and strategic importance involving heavy capital investment and high. Justify why tax incentives especially Pioneer Status and Investment Tax Allowance are important as stimulus.

Tax exemption restricted to 70 of statutory income for 5 years. Or Investment Tax Allowance of 60 on qualifying capital expenditure incurred for 5 years. Unabsorbed capital allowances and accumulated losses incurred during the pioneer period can be carried forward and deducted from the post pioneer status of the company.

Pioneer status and investment tax allowance are two of the main tax incentives available in Malaysia. Some of the major tax incentives available in Malaysia are the Pioneer Status PS Investment Tax Allowance ITA and Reinvestment Allowance RA. Minister a company granted pioneer status or issued with a pioneer certificate may surrender its pioneer status retrospectively so as to enjoy Although the Promotion of Investments Act 1986.

Solved 7 The Mechanism Of Incentives 1 Point Under Pioneer Chegg Com

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

Do You Run Or Own A Green Penang Green Council Facebook

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

Solved Justify Why Tax Incentives Especially Pioneer Status Chegg Com

Www Mida Gov My Ica Ja Ik Ja Crd Amp Fp Guidelines And

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

Acca Atx Mys Pioneer Status Part 2 Facebook

Ppt Tax Incentives Powerpoint Presentation Free Download Id 3275441

Pioneer Status Investment Tax Allowance And Reinvestment Allowance Acca Global

Business And Investment Opportunities In The Machinery Equipment Supporting Engineering And Medical Devices Sectors In Malaysia Ppt Download

Pioneer Status Investment Tax Allowance And Reinvestment Allowance Acca Global

Promoted Activities Mida Malaysian Investment Development Authority

Ppt Tax Incentives Powerpoint Presentation Free Download Id 3275441

1 Incentives For The Aerospace Shipbuilding Shiprepairing Industries In Malaysia Malaysian Industrial Development Authority Ppt Download

Lecture On Pioneer Status Youtube

Pioneer Status Investment Tax Allowance And Reinvestment Allowance Acca Global